What’s the latest plan from the left to pay for President Obama’s latest batch of stimulus spending? More taxes on high-income earners, of course. And if Senate Majority Leader Harry Reid (D-NV) gets his way, the United States’ average marginal top tax rate would be higher than all but two of the 30 most economically developed countries in the world.

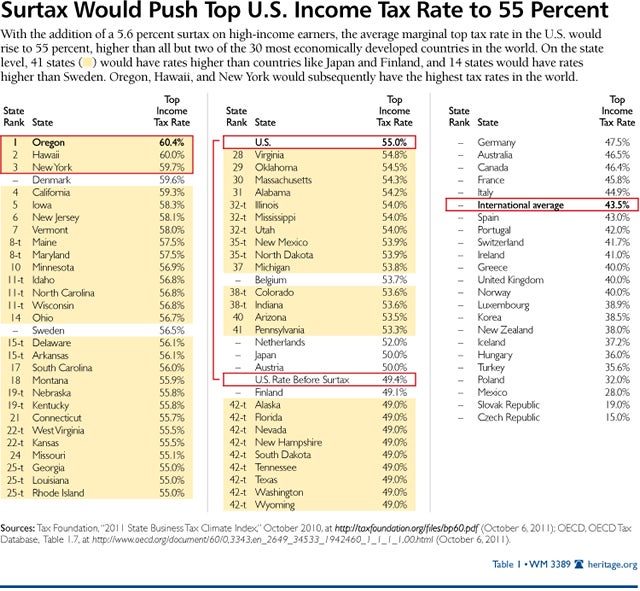

Reid has proposed a 5.6 percent surtax on incomes of married filers earning over $1 million starting on January 1, 2013–and that would push the average top U.S. income rate to 55 percent. (The surtax would kick in at $500,000 for individual filers.) In the chart below, we break down the top rate for each state and compare the numbers with other countries around the world.

In a new paper, “The Millionaire Tax: Yet Another Job-Killing Tax Hike,” Heritage’s Curtis Dubay takes a look at the impact the tax increase would have on job creation in America. In short, it would kill jobs, all in the name of creating them:

The millionaire surtax is contradictory to the stated aim of the President’s jobs plan, which is to create jobs. The tax hike would fall squarely on the very job creators that the President wants to add jobs and reduce their incentive to add new workers.

Taxpayers earning more than $1 million a year are investors and businesses that are directly responsible for creating jobs. Investors provide the capital to existing businesses and startups so they can expand and add new workers. Raising their taxes would deprive them of resources they could invest in promising businesses that are looking to add employees. Raising their tax rate would deter them from taking the risk to invest . . .

The millionaire tax would end up costing the U.S. economy more jobs than the President’s jobs plan it is supposed to pay for would ever create. It would ruin American competitiveness among other developed countries.

Click here to read more of Dubay’s paper, “The Millionaire Tax: Yet Another Job-Killing Tax Hike.”