President Obama unveiled the details of his jobs plan last week, including a proposal to offset the new government spending with tax hikes.

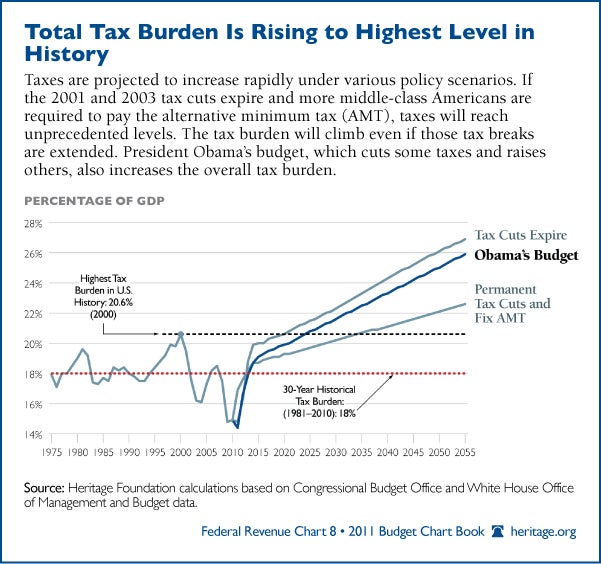

It’s a bizarre strategy for a president who says he wants to create jobs. As the above chart from Heritage’s 2011 Budget Chart Book illustrates, Americans are already grappling with the prospect of massive tax increases.

If the 2001 and 2003 tax cuts expire on Dec. 31, 2012, and more middle-class Americans have to pay the alternative minimum tax, taxes will reach unprecedented levels. The president’s budget would also increase the overall tax burden, even if the Bush tax breaks are extended.

The jobs plan isn’t exactly a new strategy from the Obama administration. Heritage’s Curtis Dubay, a senior analyst in tax policy, recently outlined the dangers of Obama’s proposal:

In the Administration’s poorly crafted and contradictory jobs package, the American people get permanent tax hikes that would enlarge the federal government to offset the cost of temporary jobs policies that would not create any jobs. In the long run, the tax hikes in this plan are more likely to destroy more jobs than the jobs policies create.

Raising taxes on working Americans couldn’t come at a worse time. With the fragile economy still recovering, Obama has put forward a plan that threatens to make things worse.

Or as Sen. Mike Lee (R-UT) told us in an interview last week: “We need to not be doing more of the same things that made the problem worse. We need to refocus on getting the federal government out of the way rather than making the federal government part of the problem.”