Social Security is currently unsustainable. It began running deficits in 2010 and its trust fund will be exhausted by 2036, which is when seniors will see about a 25 percent cut in benefits. This is the scenario we face if Congress and the President fail to enact meaningful entitlement reform and continue reckless fiscal policies. This course is reversible, however.

At a recent House Budget Committee hearing on the fiscal facts concerning Medicare and Social Security, Members were divided on how to save Social Security. Despite hearing from Steve Goss, Social Security’s chief actuary, that raising taxes is not a necessity, tax hikes remained the leading option among certain lawmakers. Both parties agree that Social Security is insolvent, but they disagree on what to do about it.

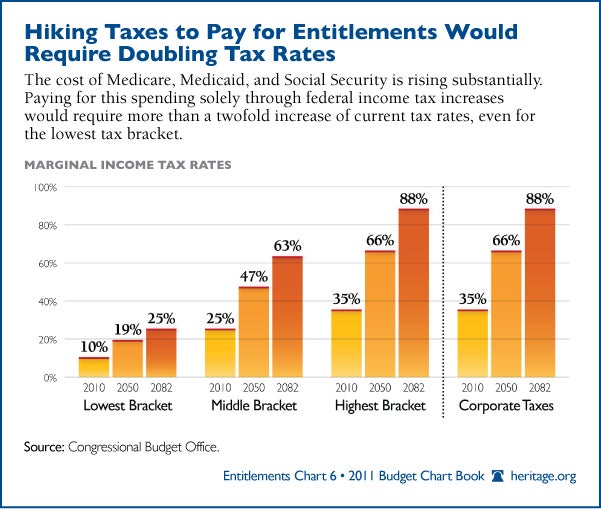

Raising taxes, however, is not an option. Amidst the greatest recession in three decades, higher payroll taxes threaten to damage the American economy. Heritage has a new plan for Social Security, as presented in Saving the American Dream. It promises to restore fiscal responsibility and protect Americans from unneeded tax hikes.

At present, workers and their employers each pay 6.2 percent for Social Security retirement and disability benefits, adding up to a 12.4 percent payroll tax that is levied on every single worker’s income. If the government were to increase this tax to pay for Social Security’s deficits, every American worker and his boss would split an increase of at least 2.2 percent. Raising these taxes will discourage employers from hiring new workers and exacerbate unemployment.

Tax-loving lawmakers then turn to the tax cap. Social Security taxes are currently deducted only from the first $106,800 each worker earns. But some lawmakers suggest that any money Americans don’t “need” is fair game for tax hikes. President Obama most recently revealed this philosophy, fundamentally at odds with America’s job creators, during a press conference on the debt limit. Similarly, certain members at the recent House Budget Committee hearing suggested lifting the cap on the Social Security payroll tax to pay for the program’s shortfall. But taking more money out of the private economy limits entrepreneurial exercise—the true source of wealth in any free-market economy.

The Heritage Foundation plan does not call for unnecessary tax increases. Instead, it restores Social Security to its original purpose of being a safeguard against senior poverty. The plan includes both a transition into a flat benefit for those who work more than 35 years, as well as phasing out Social Security benefits for those who have significant non-Social Security retirement income. The plan also contains incentives to encourage Americans to work beyond the age at which they would normally receive benefits. Because Americans are living longer than ever before, they are spending more years in retirement. Therefore, Saving the American Dream calls for gradually increasing the retirement age and then indexing it to life expectancy.

Unemployment remains high, and Social Security faces serious fiscal challenges. It simply cannot afford to pay all of the future benefits it has promised. Elected leaders must realize that tax hikes are not the answer and that there are different ways to save both Social Security and the economy. Saving both requires our attention now, and as Heritage’s David John writes, “ [I]nstead of just blindly defending the current program, both Congress and the Obama Administration should propose comprehensive programs that permanently fix Social Security.”