Today’s Wall Street Journal has some bad news that most Americans are already painfully aware of. President Barack Obama’s recovery is plodding along at a snail’s pace:

Two years ago, officials said, the worst recession since the Great Depression ended. The stumbling recovery has also proven to be the worst since the economic disaster of the 1930s.

Across a wide range of measures—employment growth, unemployment levels, bank lending, economic output, income growth, home prices and household expectations for financial well-being—the economy’s improvement since the recession’s end in June 2009 has been the worst, or one of the worst, since the government started tracking these trends after World War II.

In a new paper, The Heritage Foundation’s James Sherk confirms the bad news and writes that if economic growth continues at the 2003–2007 rate of expansion, unemployment will not return to pre-recession levels until 2018. Sherk paints a picture of where the dismal unemployment numbers stand:

The recession officially ended in June 2009, but payroll employment remains 6.9 million jobs below its December 2007 peak. The average unemployed worker has been without work for 39.7 weeks (nine months)—the longest since the government began keeping track in 1948.

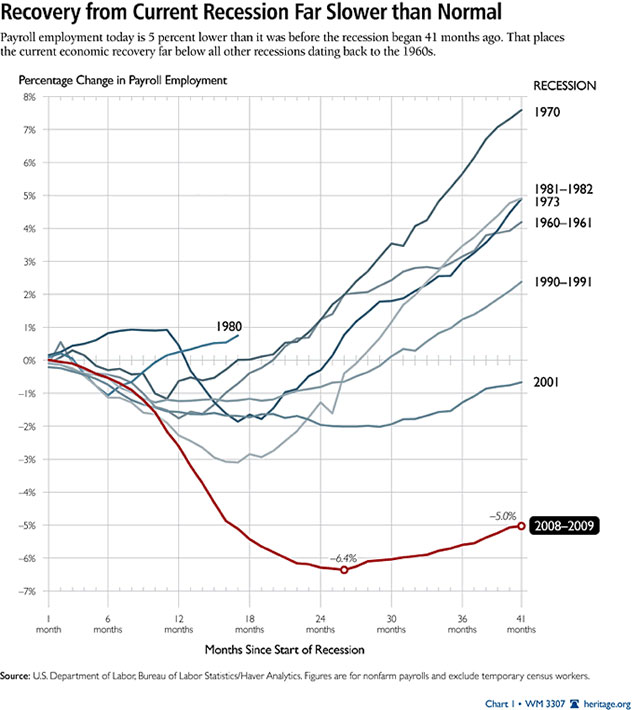

This is the weakest recovery of the post–World War II era. In past recessions, employment fully recovered within two to three years. As of May 2011—three and a half years after the recession’s onset—payroll employment remains 5 percent below pre-recession levels. Unemployment stands at 9.1 percent.

Sherk also notes that a slow recovery is likely and breaks down what the unemployment rate could look like under several scenarios. At an average of 260,000 net jobs added per month, unemployment will not return to its natural rate until August 2014. At an average of 216,000 new jobs per month, it will take until October 2015 to return to normal. But, Sherk warns:

These are optimistic assumptions. The late 1990s was a period of unusually strong economic growth. During the 2003–2007 expansion, employers added an average of 176,000 jobs per month. If the recovery takes that more recent pace, unemployment will not return to normal rates until January 2018.

On Friday, the Department of Labor will release its monthly jobs report. Hopefully the news is better than last month, which saw an unemployment rate that climbed to 9.1 percent as the economy created only 54,000 new jobs. Meanwhile, the labor force participation rate remained flat at 64.2 percent, an all-time low for the fifth straight month.

Unfortunately, those numbers aren’t indicative of an economy moving into high gear — and they foretell depressingly high unemployment into the distant future. Sherk writes:

Over the past year, employment has grown by an average of just 122,000 jobs per month. If job growth continues at this rate, then the unemployment rate in January 2021 would stand at 7.4 percent. At the current rate of recovery, high unemployment will become the new normal.